A recent statement issued by the Malta Developers Association claimed that data for March shows that the property industry is thriving.

MDA argued that property valued at over €410 million was sold throughout March, with the number of promises of sale increasing by 16% and their value growing by 7%.

“This was the best-ever March recorded with the exception of 2021 when Covid recovery measures for the sector were being phased out,” the association said, describing real estate as “the investment of choice of most Maltese families”.

Data published by the National Statistics Office on Tuesday appeared to cast doubt on this assessment, leading some to question the true figures. Activist Wayne Flask described the MDA statement as “an attempt to deny the evidence, from someone who knows that the spring is running dry”.

The NSO data breaks down the property sector’s performance by looking into the total number or value of final deeds and promise of sale agreements signed each month as well as those involving individual buyers or households. This provides an indication of how many property deals involve residential properties and how many relate to commercial properties.

Was €410m worth of property really sold during March?

According to NSO, the true figure is even higher, with a total of just over €456 million worth of property sold throughout March 2023.

Nonetheless, this is less than what was sold in either March 2021 or 2022, during which almost €510m and €481m worth of property were sold respectively, making it the lowest return since the Covid-hit month of March 2020.

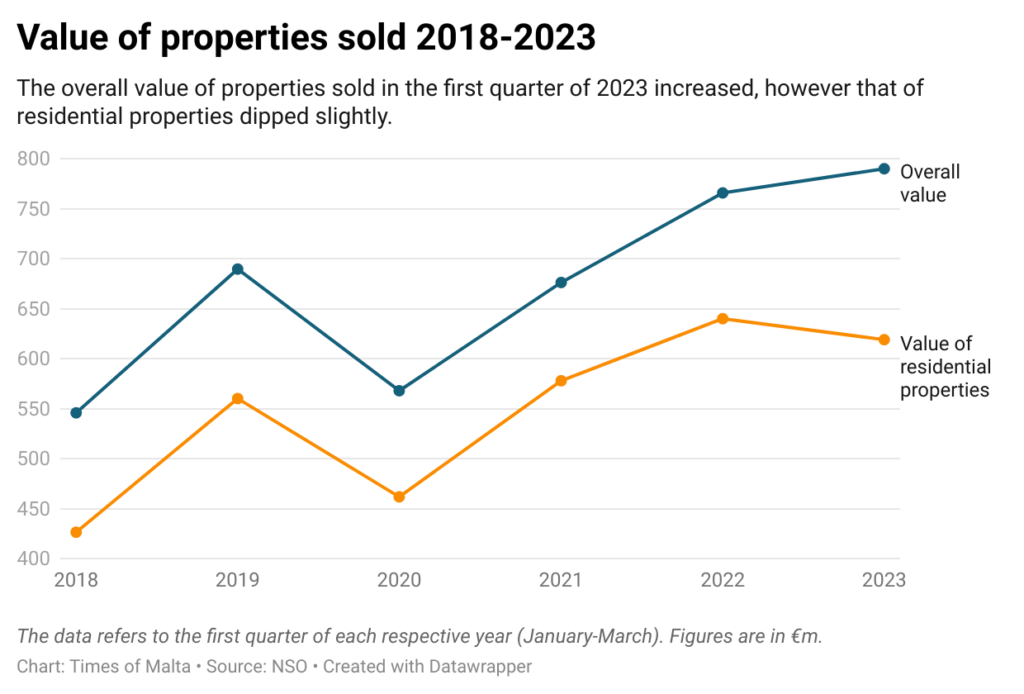

The data for the first quarter of the year, on the other hand, shows that the overall value of properties sold has increased over previous years, reaching almost €790 million this year, the highest figure recorded in the last six years.

However, this increase in value appears to be mostly driven by the sale of commercial properties. The value of residential properties sold in the first quarter of this year decreased by €21 million compared to last year’s figures, while that of non-residential properties grew by €45 million.

Although 92% of all properties sold during the first three months of this year were residential properties, these only made up 78% of the total value of the properties sold. This is a dip from the 84% registered last year and 85% in 2021, and the lowest this figure has been since 2018.

Are promise of sale agreements really increasing?

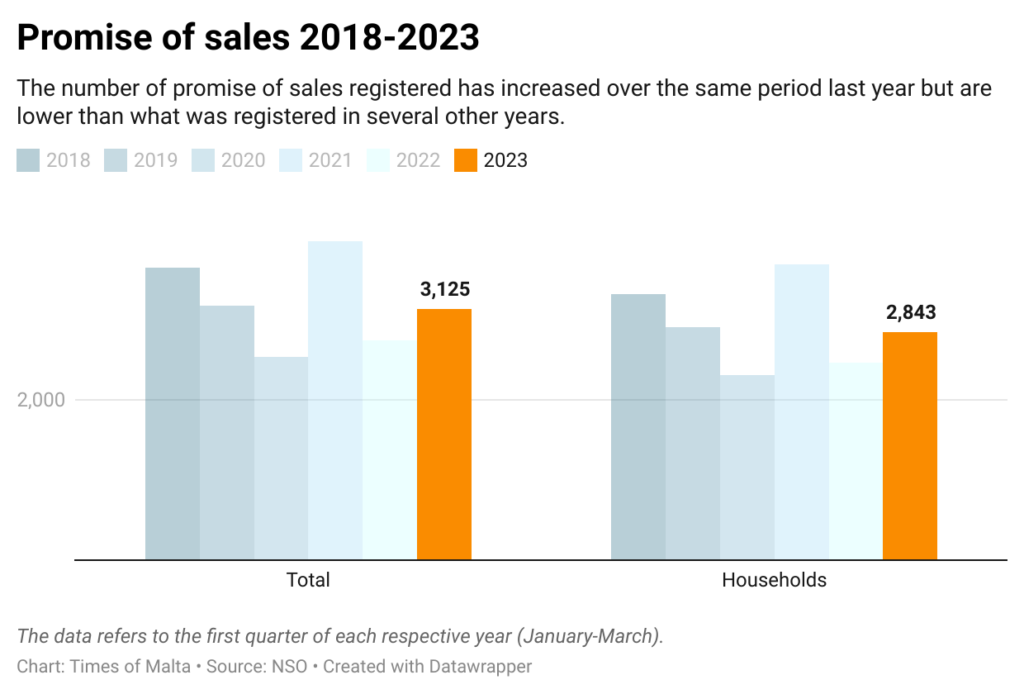

Yes, NSO data shows that promise of sale agreements have increased, both over the past month as well as in comparison to the first quarter of last year, with a total of 3,125 promise of sale agreements registered in the first three months of the year.

Promise of sale agreements during the month of January increased particularly sharply, rising from 663 in January 2022 to 920 in January 2023, a 54% increase. A recent KPMG analysis attributes this rise to “government incentives offered to different buyer segments originally targeted to end by 2021”.

However, the number of promise of sale agreements registered is still lower than the corresponding period for several other years on record.

The MDA statement rightly points out that 2021 registered higher promise of sales figures, attributing this to the phasing out of COVID recovery measures. Yet the data shows that more promise of sale agreements were recorded during the same period in both 2018 and 2019.

Furthermore, promise of sale agreements may not be a reliable indicator of the property sector’s performance. As KPMG highlights, “promise of sales agreements may fall through before the final deed of sale is signed” and “a single promise of sale agreement may involve more than one property, although the vast majority involve only one”, which could result in an overestimation or underestimation of the demand for property respectively.

Does this mean that more properties are being sold?

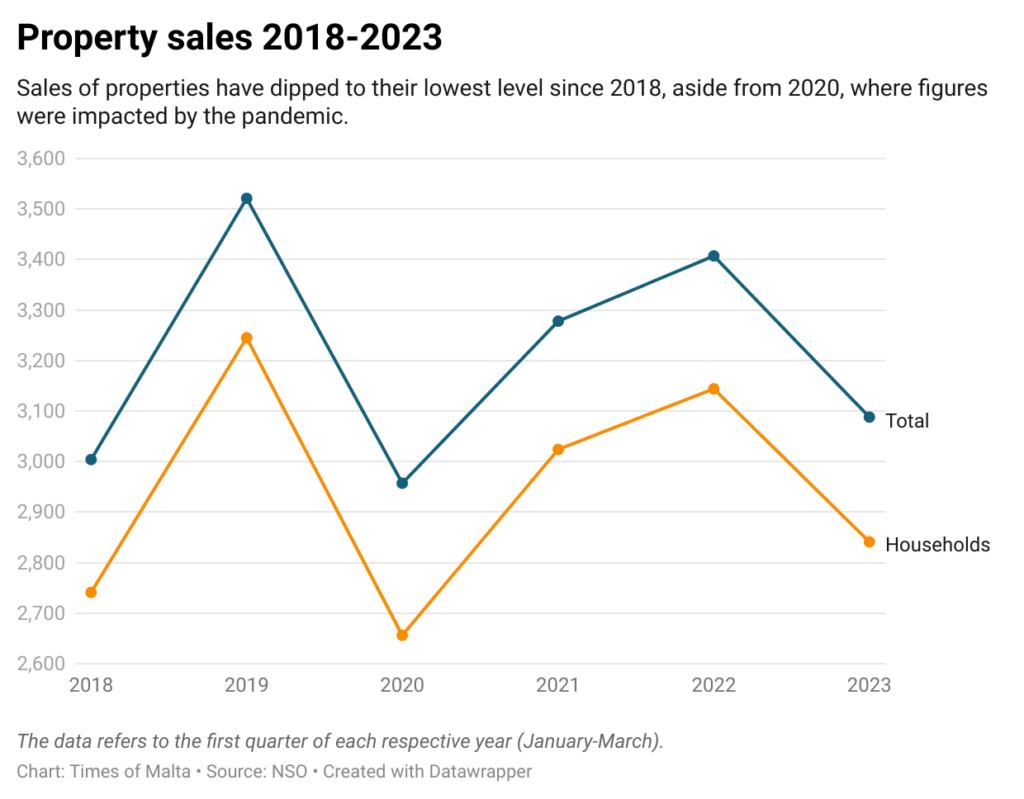

No, the data shows that the number of properties sold has dipped to the lowest point since 2018, aside from the pandemic-hit 2020.

In total, 3,088 final deeds were signed in the first three months of 2023, down from 3,407 last year and 3,278 in 2021.

The sale of residential properties also fell by over 300, or almost 10%, since last year, also marking the lowest return since 2018, aside from 2020.

Was March 2023 the sector’s ‘best-ever’ March?

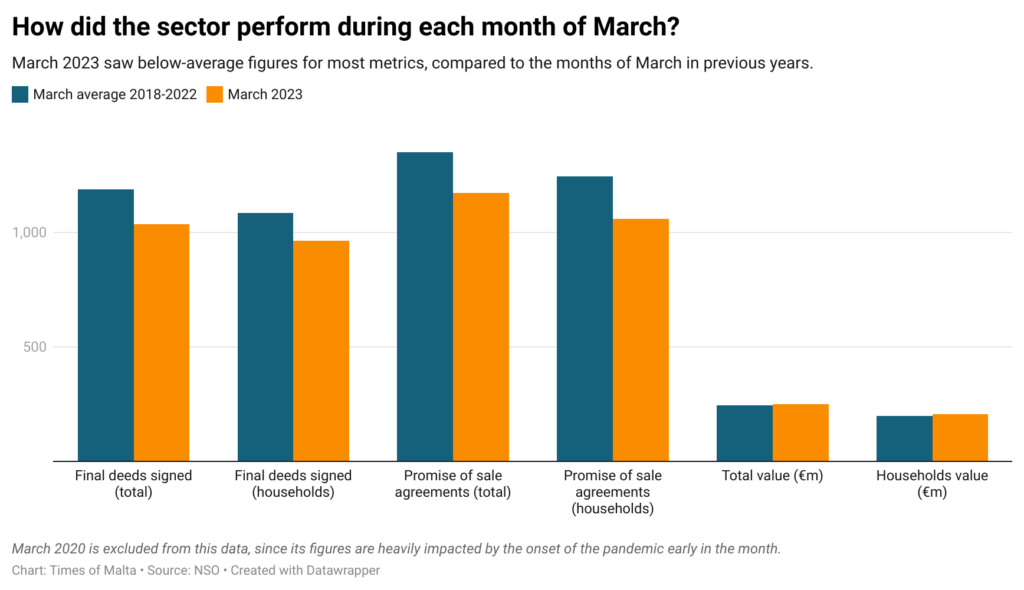

No, the data suggests that March 2023 generally recorded lower-than-average results across several metrics.

Discounting March 2020, where figures are skewed due to the onset of the pandemic early in the month, March 2023 recorded a below-average number of total property sales and residential property sales, as well as below-average promise of sales for both households and commercial properties.

On the other hand, the value of properties sold during March 2023 was slightly above average.

Verdict

National data shows that fewer properties were sold compared to most previous years. Sales of residential properties, in particular, have decreased.

While promise of sale agreements have increased compared to last year, this year’s figures are still lower than several other years on record.

On the other hand, the overall value of property sold this year has increased, despite the value of residential properties sold dipping. This suggests that the value in the property market is being increasingly driven by the sale of commercial, rather than residential, properties.

The data described by MDA in their statement only refers to March, while that presented in this analysis looks into the first three months of the year. Trends over a longer period of time would need to be analysed in order to reach a more accurate understanding of the sector’s performance.

As it stands, the data for this year suggests that while the sector is not in crisis, it is experiencing a decline.

This claim is therefore mostly false because the evidence generally refutes the claim, although some minor aspects may be accurate.

The Times of Malta fact-checking service forms part of the Mediterranean Digital Media Observatory (MedDMO) and the European Digital Media Observatory (EDMO), an independent observatory with hubs across all 27 EU member states that is funded by the EU’s Digital Europe programme. Fact-checks are based on our code of principles.

Let us know what you would like us to fact-check, understand our ratings system or see our answers to Frequently Asked Questions about the service.