A Eurostat report published in April showed that labour costs in Malta have remained unchanged in eight years. This indicates that wages have stagnated since 2016.

The report caused a furore. The Labour Party reacted by claiming that wages are up 25% in that period. The National Statistics Office issued a clarification note, and Eurostat later revised its data.

So what does the data really show?

Labour cost or wages?

The two are not identical, although they are closely entwined.

Wages are whatever money a worker earns at the end of each month. Changes in wages from one period to the next are often captured by looking at the average wage across the country.

Meanwhile, labour cost refers to how much it costs an employer to engage an employee. The bulk of this cost (over 90% of it, at last count) is made up of the employee’s wages and their social security contributions paid by their employer, but it also includes some other additional costs.

So, in simple terms, if an employee’s wages increase, the employer’s labour costs are likely to shoot up in parallel.

But labour costs can be cushioned by government intervention and subsidies, making it cheaper to employ staff. This is what happened during the COVID-19 pandemic, when the government forked out a wage subsidy of up to €800 each month to cover the wages of employees across many sectors.

This meant that employers’ labour costs dropped during that period, since government was partly covering the cost of paying staff. This created an anomaly in data for Malta’s labour costs during that year, with figures artificially low thanks to the government’s uncharacteristically heavy intervention.

What are Malta’s labour costs?

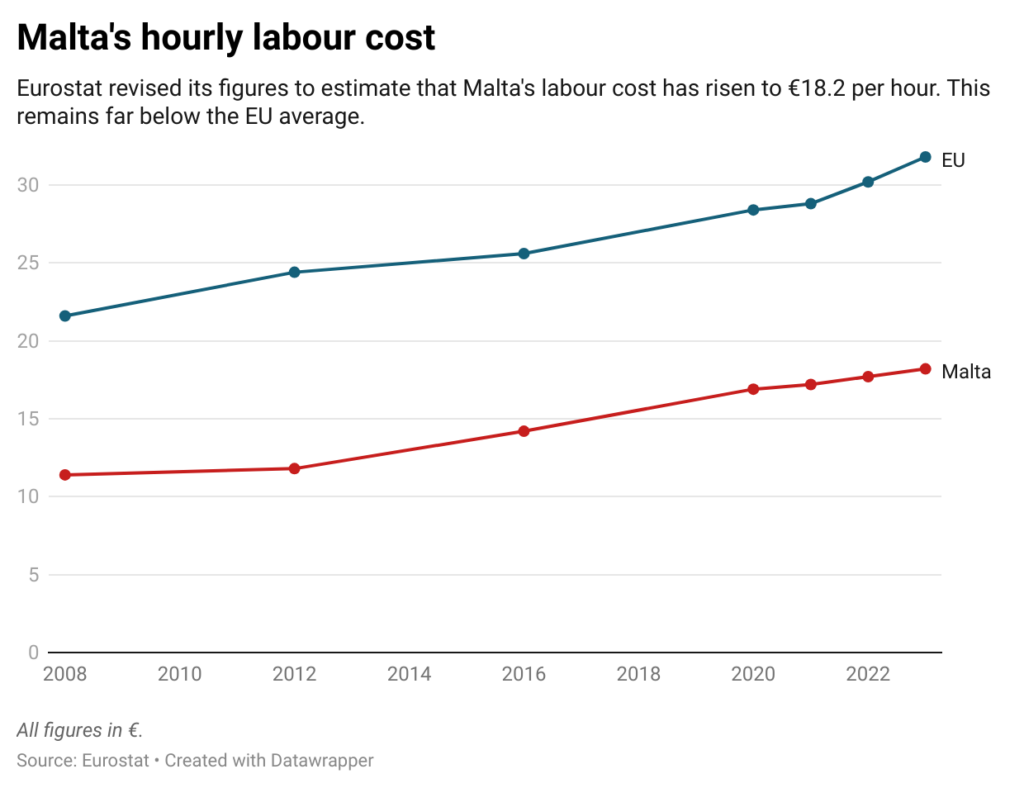

The figures presented last month by Eurostat were partly shaped by this anomaly, since they were based on an NSO study from 2020, at a time when labour costs were artificially low due to government intervention.

The study, known as the Labour Cost Survey, is carried out every four years, meaning that the 2020 edition is the most recent data available.

Eurostat later revised its figures to base its calculations for Malta’s labour costs upon the previous edition of this study, namely that carried out in 2016.

Following this revision, Eurostat now calculates Malta’s labour costs to have been €18.2 per hour last year, rather than the €14.2 initially estimated.

This means that Malta’s labour costs have increased by €4 since 2016, when it cost €14.2 per hour for an employer to engage a worker.

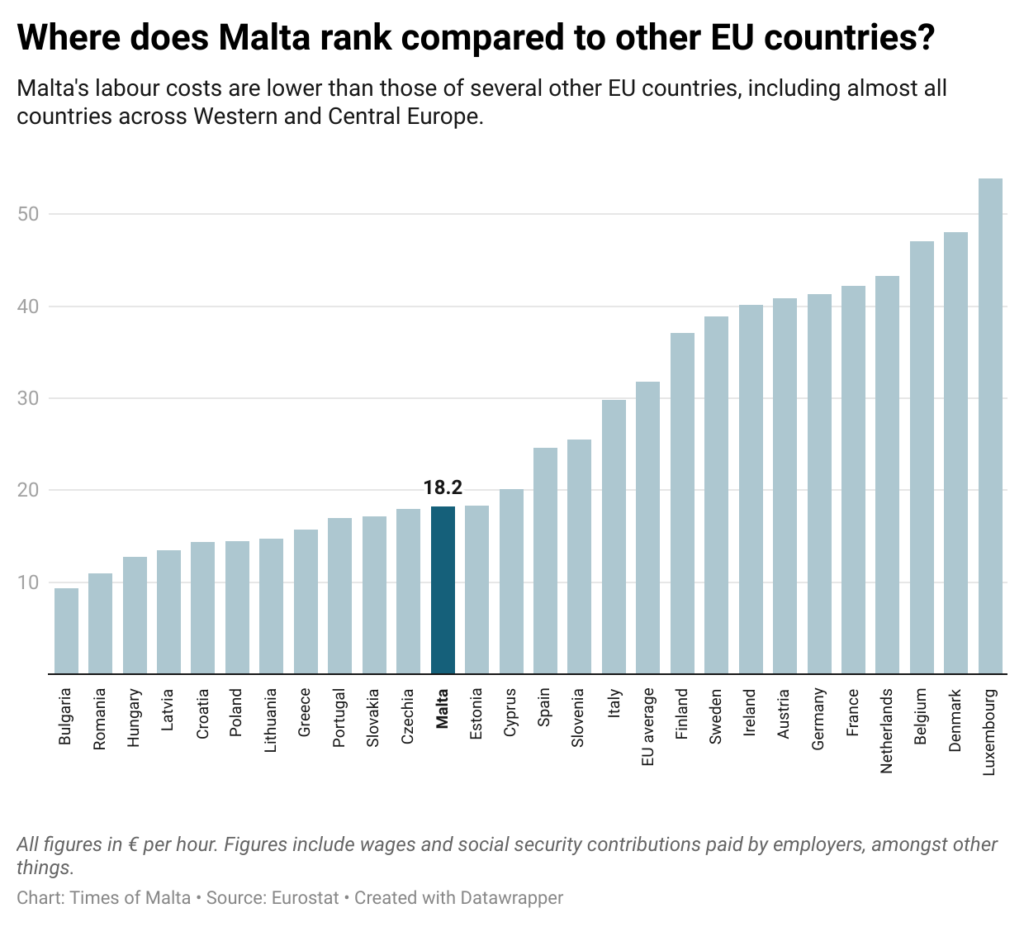

Despite the increase, Malta still pales in comparison to the EU average (€31.8) and to that of almost all countries across Western and Central Europe (the exception to the rule being Portugal, at just €17 per hour).

The new data means that Malta is no longer ranked amongst the bottom five in Europe, as previously appeared to be the case. Malta now finds itself ahead of 11 EU countries, sandwiched between Czechia (€18) and Estonia (€18.3).

How have Malta’s wages changed?

Other data gives us a clearer view of how wages have changed.

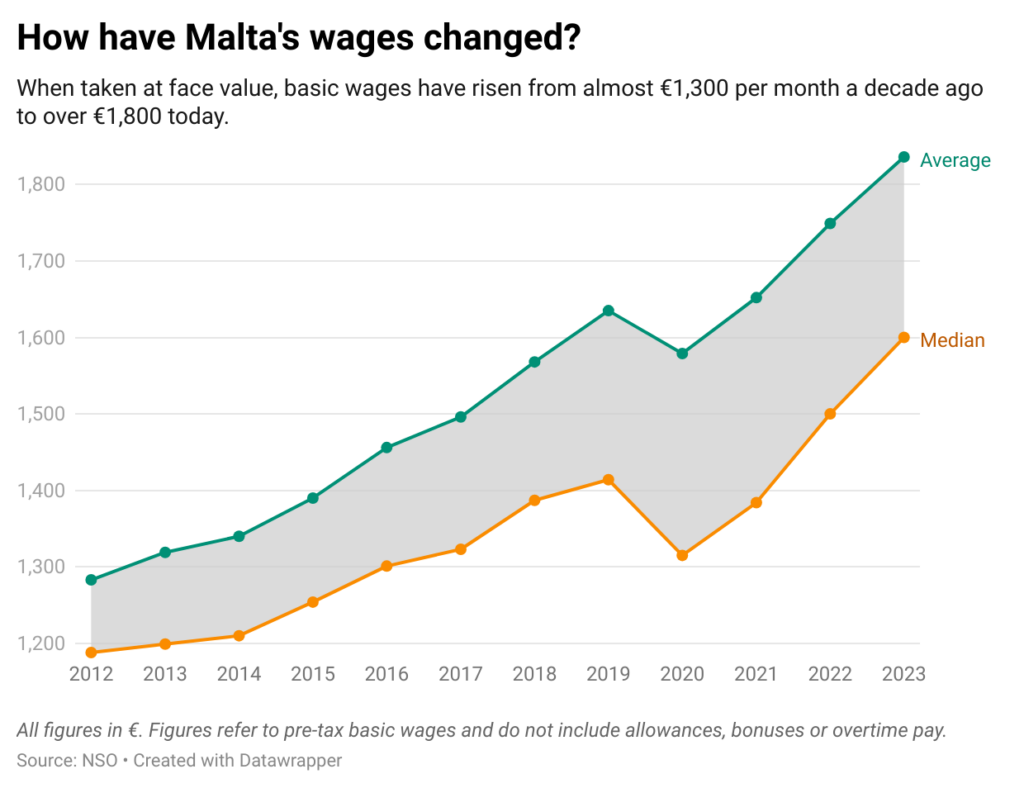

If we look at the past decade, official data says that wages have increased from an average of just under €1,300 per month in 2013 to a little over €1,800 last year (roughly going from €16,000 per year in 2013 to €22,000 in 2023).

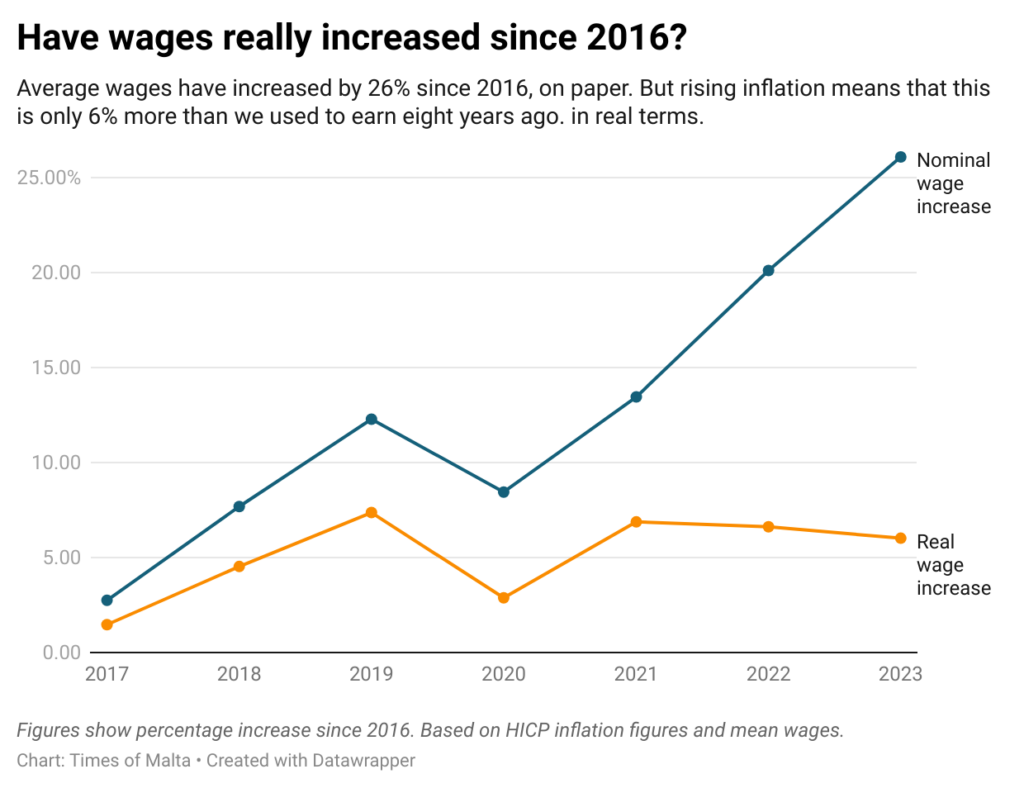

This means that wages have shot up by 43% on average since 2013 (and by 26% since 2016 alone), with wages increasing every year, except for the pandemic-stricken 2020 and 2021.

When looking at the median wage – rather than the average – the increase is less dramatic, rising from under €1,200 per month in 2013 to €1,600 last year.

In practice, this means that half the population earned under €1,600 last year, and the remaining half earned more.

Using the median calculation is useful as it prevents individuals on either extreme of the wage spectrum from skewing results.

Gap between high and low earners increasing

The distance between the average and the median wage has also grown noticeably from one year to the next.

While in 2013 there was only a €94 difference between the average and median monthly wage, this is now up to €236. This suggests that the gap between high and low earners is widening, with more high-income individuals dragging the average up.

But there are some significant caveats to these figures. First of all, they are pre-tax figures, meaning that some people’s take-home pay could be significantly lower than the figures suggest.

Secondly, these figures only cover people’s basic pay and do not include additional perks, such as allowances, bonuses or overtime payments, which are often used to top up salaries, particularly in higher-ranking roles.

This raises questions over wage inequality across the country, with higher earners likely to be earning well above these figures, once you tot up their allowances and benefits.

Other measures also hint at growing inequality across Maltese society over the past decade. Malta’s most recent Gini coefficient (a measure used to calculate how equally wealth is spread across a country) was at 31.1% last year, higher than the 27.9% registered in 2013 and the 28.5% in 2016, showing that inequality is on the rise.

This despite Malta’s minimum wage increasing to €213.54 this year, up from €192.73 last year and €168.01 in 2016.

Do we really have more money in our pockets?

Well, not exactly. Or, at least, not to the extent that the wage increases would have you think.

An increase in wages needs to be viewed alongside a corresponding increase in the cost of living. So, the theory goes, although we may be earning more, we may also be spending more to meet our basic needs.

While Malta’s average wages have increased by over a quarter since 2016 on paper, taking inflation into account means that this only translates to a 6% increase over the past eight years. So although what we earn today is some 26% more than what it was in 2016, we are ultimately only left with 6% more in our pockets.

This is even lower if, instead of the average, we calculate this based on the median wage – instead of 6%, we are now down to just 3.4%.

Two key factors had a devastating effect on Malta’s wages. The first is the pandemic, which knocked the wind out of the sails of the steady wage increases that were taking place in previous years.

The second is the cost of living crisis which reared its head over the past years and which, as KPMG previously argued, has entirely eaten into any wage increases over the past several years.

Verdict

Malta’s hourly labour costs have increased by €4 since 2016, according to recently revised EU figures.

Monthly pre-tax wages have increased by some €500 over the past decade, rising from an average of €1,300 in 2013 to over €1,800 last year. The median wage also increased during this period, from almost €1,200 to €1,600.

However, these figures do not include allowances, benefits and overtime payments. This means that real income figures, especially for higher earners who are more likely to receive higher benefits, is almost certainly higher.

The gap between the average and median income has also grown, suggesting a widening gap between very high earners and the rest.

Although wages have increased on paper, their real growth is much less than the figures would suggest, with inflation eating into wage increases.

While the average wage today is 26% higher than it was in 2016, this drops to just 6% after inflation is taken into account. This drops further to 3.4% if we look at median wages, rather than average wages.

The Times of Malta fact-checking service forms part of the Mediterranean Digital Media Observatory (MedDMO) and the European Digital Media Observatory (EDMO), an independent observatory with hubs across all 27 EU member states that is funded by the EU’s Digital Europe programme. Fact-checks are based on our code of principles.

Let us know what you would like us to fact-check, understand our ratings system or see our answers to Frequently Asked Questions about the service.